Now is the perfect time to invest in advanced 3D scanning and printing equipment—and keep more of your money at tax time.

Thanks to Section 179 of the U.S. tax code, qualifying equipment purchases made and placed into service before December 31, 2025 can be deducted in full this year, rather than depreciated over time. That means upgrading your workflow with NeoMetrix’s industry-leading solutions—like the HandySCAN, MetraSCAN, INTAMSYS FUNMAT PRO 310, or BigRep VIIO 250—not only boosts productivity and precision, it also delivers significant year-end savings.

The Scan-to-Print Process – Efficiency from Start to Finish

Our Scan-to-Print workflow eliminates guesswork and manual inefficiencies:

- Capture: Using high-precision 3D scanners, we capture accurate geometry of existing parts or components.

- Process: The scan data is transformed into a usable CAD model for inspection, design changes, or manufacturing.

- Produce: The final model is sent directly to an advanced 3D printer, delivering a ready-to-use part with minimal lead time.

This integrated process ensures design accuracy, reduces waste, and enables rapid prototyping and production.

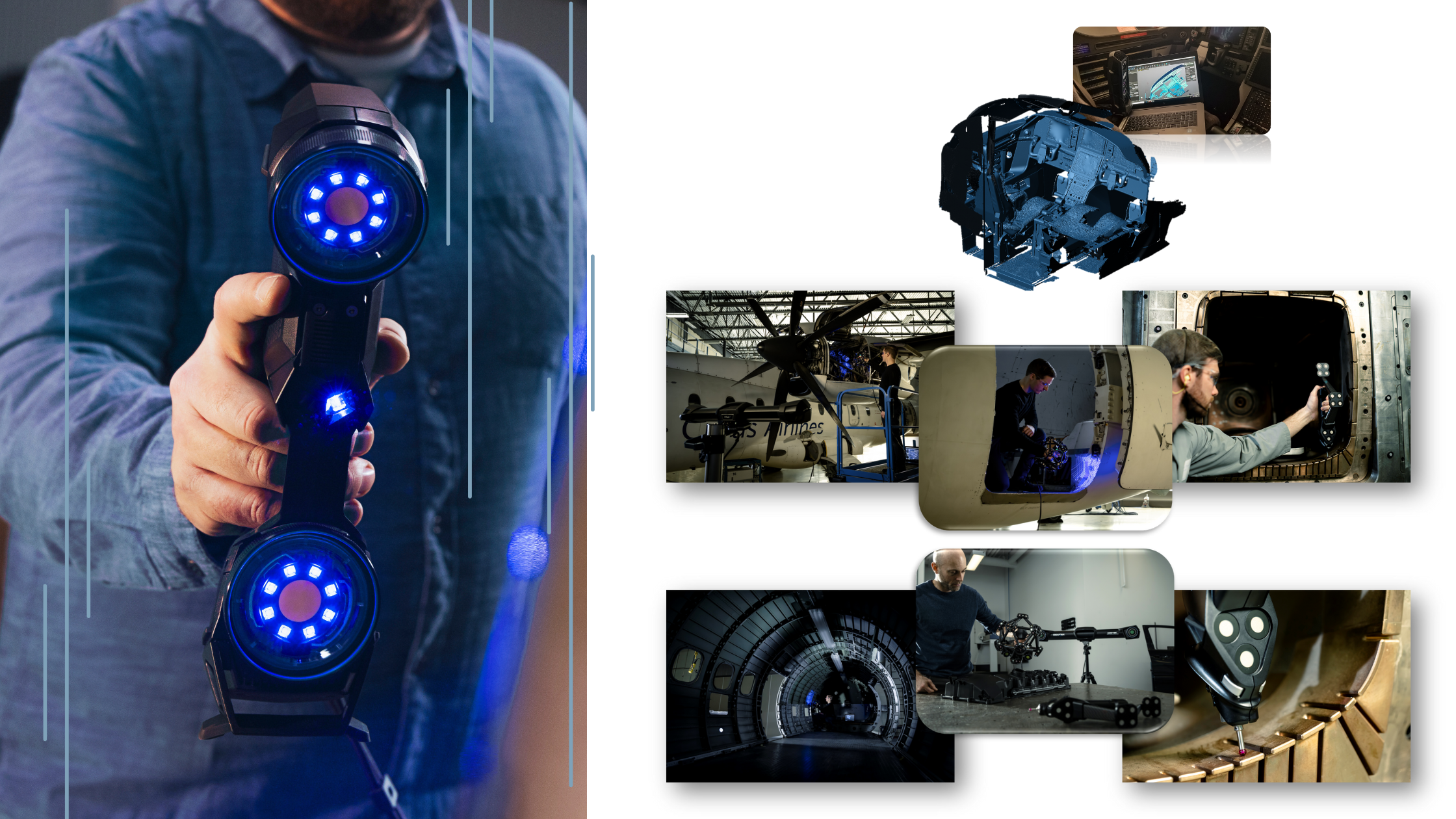

Industry-Leading 3D Scanning Systems

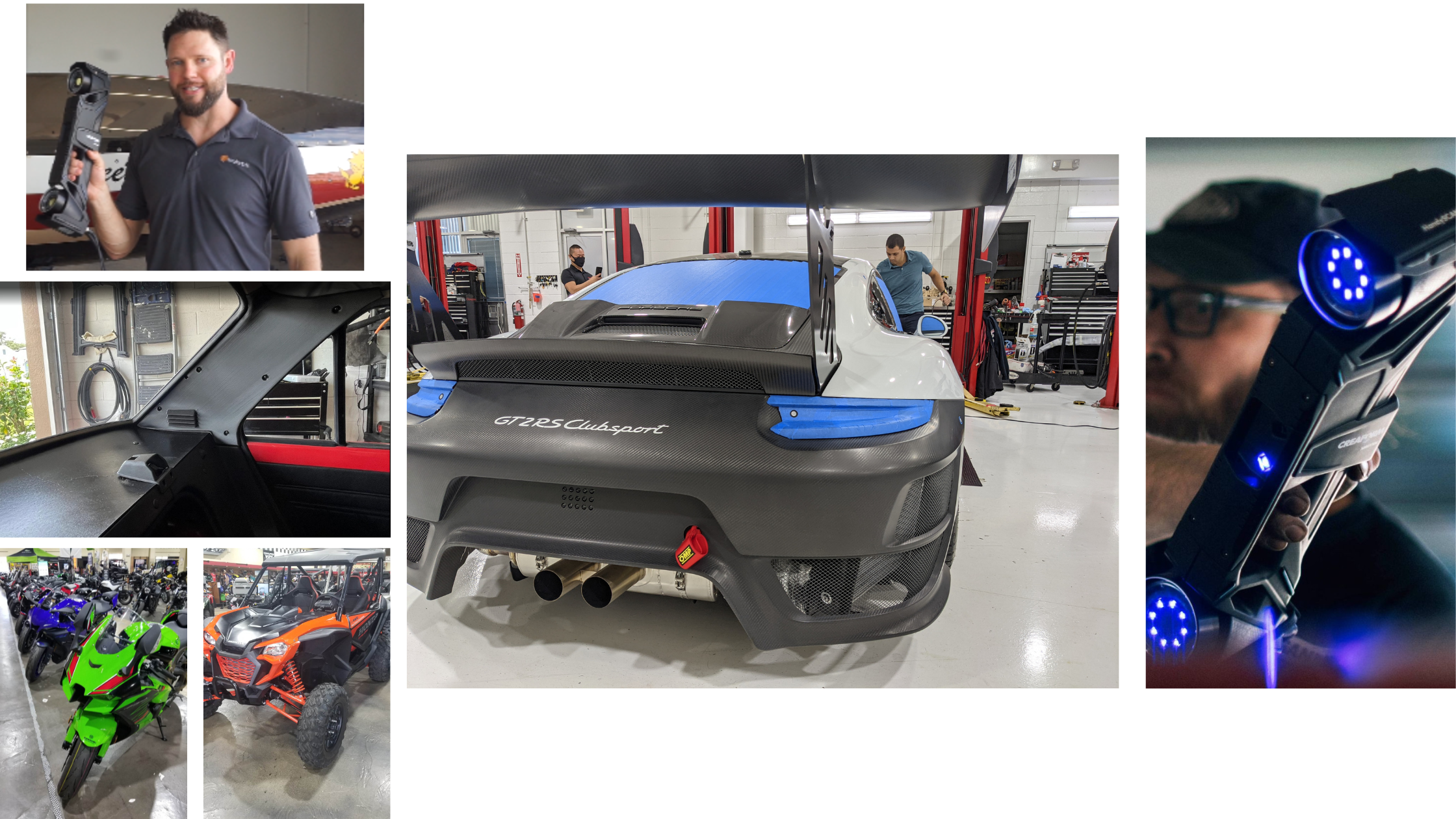

HandySCAN – Reverse Engineering Excellence – Learn More

The Creaform HandySCAN is the gold standard in portable metrology-grade scanning. Its speed, versatility, and accuracy make it ideal for reverse engineering legacy parts, creating digital twins, or preparing designs for 3D printing.

MetraSCAN – Inspection & Metrology at Production Speed – Learn More

The Creaform MetraSCAN delivers rapid, shop-floor-ready inspection capabilities. Ideal for quality control, it provides precise, repeatable measurements—even in harsh manufacturing environments—making it perfect for validating part accuracy and ensuring compliance with tight tolerances.

Next-Gen 3D Printing Systems – Accelerate Business and Production

INTAMSYS FUNMAT PRO 310NEO – Learn More

Designed for high-performance engineering applications, the FUNMAT PRO 310 handles a wide range of advanced thermoplastics. Its dual-nozzle system, high-temperature chamber, and industrial-grade reliability make it a powerful solution for aerospace, automotive, and manufacturing industries.

BigRep VIIO 250 – Learn More

The BigRep VIIO 250 brings large-format additive manufacturing to the production floor, enabling the creation of full-scale prototypes, jigs, fixtures, and end-use parts. With its precision, speed, and capacity, it’s ideal for businesses looking to scale production while maintaining quality.

Leverage Section 179 for Maximum ROI

When you invest in equipment from NeoMetrix, you’re not just improving production—you may also reduce your tax burden thanks to Section 179 of the U.S. tax code.

What is Section 179?

Section 179 allows businesses to deduct the full purchase price of qualifying equipment—new or used (but new to your business)—in the year it is placed into service, rather than depreciating it over several years.

For 2025:

-

Deduct up to $2,500,000 on eligible equipment purchases.

-

Applies to businesses that purchase $4,000,000 or less in qualifying assets.

-

Bonus depreciation allows 100% first-year depreciation on amounts above the Section 179 limit—available until January 1, 2026.

Example:

If you purchase $200,000 worth of equipment, instead of spreading out the deduction over its useful life, Section 179 allows you to deduct the full amount this year—reducing taxable income and improving cash flow.

Eligible equipment includes:

-

Machinery & manufacturing equipment

-

Office furniture & technology

-

Commercial vehicles

-

Computers & software

-

And more

- NeoMetrix provides this information to raise awareness of this great opportunity.

- Please consult your tax professional to see how these changes may affect your situation.

Have Questions?

Contact us for more information!